Are you exploring a more autonomous way to trade cryptocurrencies? Look no further than EdgeX Exchange, a revolutionary decentralized platform. This groundbreaking ecosystem empowers you to conduct trades directly, giving you full authority over your assets. With EdgeX Exchange, you can, navigate a world of unrestricted trading opportunities.

Unleash the autonomy that comes with decentralized trading and embrace a community of like-minded individuals who value transparency. EdgeX Exchange is more than just an exchange; it's a community toward a just financial future.

- Join the decentralized trading revolution today!}

- Discover the benefits of EdgeX Exchange and unlock its full potential.

Unleashing Bitcoin's Potential: A Deep Dive into DEX Exchanges

The decentralized finance (DeFi) ecosystem has revolutionized the way we engage with financial instruments. At the heart of this revolution lie Decentralized Exchanges (DEXs), platforms that empower users to trade copyright assets directly, excluding edgex exchange intermediaries like traditional brokers. DEXs offer a paradigm shift in transparency, security, and ownership, making them an attractive alternative for the burgeoning Bitcoin community.

- Leveraging the inherent properties of blockchain technology, DEXs enable peer-to-peer transactions that are immutable and verifiable.

- This eliminates the risk of centralized failure, a common concern with centralized exchanges.

- Moreover, DEXs often incorporate advanced features like yield farming and liquidity management, allowing users to acquire passive income from their copyright holdings.

As Bitcoin's adoption continues to increase, DEXs are poised to play an increasingly crucial role in unlocking its full potential. They provide a reliable and independent platform for Bitcoin users to engage with the broader DeFi ecosystem, promoting innovation and financial inclusion.

Trading the Decentralized Market

The decentralized finance (DeFi) ecosystem has exploded in popularity, offering users alternatives to traditional financial platforms. Among the most common swaps within DeFi are Bitcoin-ETH USDT swaps. These deals involve exchanging between these three prominent cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), and Tether (USDT).

Understanding this decentralized market, however, can be complex for newcomers traders. Decentralized exchanges serve as the backbone of these swaps, offering openness. But understanding factors like market fluctuations, gas fees, and safeguards is crucial for successful Bitcoin-ETH USDT swaps.

- Research different DeFi platforms and their features to find the best fit for your needs.

- Assess fees, liquidity, and security measures before executing any swap.

- Employ limit orders to minimize slippage and ensure you get the desired price for your trade.

Keeping informed about market trends and legal developments is also essential for navigating the dynamic world of Bitcoin-ETH USDT swaps.

Decentralized Finance's Future?

EdgeX Exchange is rapidly evolving as a promising player in the dynamic landscape of decentralized finance. With its commitment on integration, EdgeX aims to bridge disparate protocols within DeFi, creating a more seamless user environment. If the industry remains to be seen, but its disruptive approach has captured the attention of investors worldwide.

- Essential components that set EdgeX apart include:

- Community-driven decision-making

- Robust encryption measures

- Seamless interoperability between blockchains

Transparency in Action: Bitcoin DEX Exchanges Explained

In the ever-evolving landscape of copyright trading, decentralized exchanges (DEXs) are gaining traction. These platforms offer a revolutionary solution to traditional financial markets, empowering users with greater control. When it comes to Bitcoin, DEXs offer a compelling alternative that prioritizes transparency.

- Trades within a Bitcoin DEX are publicly viewable, recorded on an immutable blockchain ledger. This extent of transparency confirms that all trades are verified.

- Automated agreements govern the operations of DEXs, minimizing the risk of unauthorized actions.

- Users maintain full ownership over their digital assets, eliminating the threat of security breaches.

Consequently, choosing a Bitcoin DEX exchange enables traders to execute transactions with greater certainty. The power of transparency promotes a stable trading environment, benefiting both individual traders and the broader copyright ecosystem.

ETH/USDT on the Blockchain: Exploring Decentralized Exchanges

Within the dynamic realm of copyright trading, decentralized exchanges (DEXs) have emerged as a compelling alternative to traditional centralized platforms. Facilitating traders with increased control over their assets and promoting financial transparency, DEXs operate on blockchain technology, eliminating the need for intermediaries and fostering a more autonomous trading experience. One of the most widely-used copyright pairs on DEXs is EthUSDT, representing the pairing of Ethereum (ETH) with Tether (USDT), a stablecoin pegged to the US dollar. This combination offers traders the benefits of both volatile opportunity within the ETH market and the stability provided by USDT.

- Harnessing smart contracts, DEXs enable seamless and protected trading directly between users.

- EthUSDT trades on numerous DEX platforms, each with its own specialized features and user interface.

- Pinpointing the right DEX for your needs depends on factors such as trading volume, fees, and supported cryptocurrencies.

As the copyright landscape continues to evolve, decentralized exchanges are poised to play a significant role in shaping the future of trading. EthUSDT's prominent position within this ecosystem highlights the growing demand for transparent and streamlined trading solutions.

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Danica McKellar Then & Now!

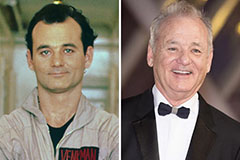

Danica McKellar Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!